Mortgage Contingency: Why it matters for buyers and sellers

When financing looks questionable, mortgage contingencies come into play. Find out how Better can provide assurances with funding.

Read more

When financing looks questionable, mortgage contingencies come into play. Find out how Better can provide assurances with funding.

Read more

RefiPossible is a loan option designed for those who may not qualify for a conventional refinance, or missed the 2020 refinance wave.

Read more

Starting in September, Fannie Mae will allow renters to use their rental payment history as credit on their mortgage application.

Read more

Discover how loan subordination lets you refinance while keeping a second mortgage: What it is, how it works, key steps, and why it’s important.

Read more

Wondering if getting pre-approved hurts your credit? Discover how credit checks work and simple ways to keep your score safe during the mortgage process.

Read more

As bidding wars cool off and home prices begin to level out, buyers who took a break this summer might be ready to dive back in.

Read more

With rates still low, many first-time buyers are becoming homeowners through government-backed mortgages, including the FHA loan.

Read more

Lenders will evaluate credit scores differently starting September 18th, and homeowners may be in a position to save even more on their next refinance.

Read more

Homeowners who were previously denied a mortgage refinance may now qualify through RefiPossible™. You may save up to $3k/yr by lowering your monthly costs.

Read more

How long does a mortgage pre-approval last? Learn how long a mortgage pre-approval stays valid, what factors shorten it, and when to renew before it expires.

Read more

Can’t afford surprise repairs or vet bills? Learn how to protect your home, belongings, and pets with affordable insurance from Better Cover and Lemonade.

Read more

For one local man, being able to live on the river is much more than a perk—it’s personal.

Read more

The foreclosure ban has ended. Find out what it means for millions of homeowners, the choices you face now, and how to safeguard your home today.

Read more

Learn how to get pre-approved for a mortgage, when to apply, and what to expect before, during, and after, so you can prepare confidently to buy your home.

Read more

First-time homebuyers are getting left behind as home prices skyrocket. Follow these tips to improve your standing, without putting more money down.

Read more

Learn the differences between FHA and Conventional loans, and find out which is the best choice for you with our step-by-step guide.

Read more

When looking at a mortgage, paying points means paying more upfront for a lower interest rate. On the other hand, getting credits means paying less at closing in exchange for...

Read more

There is more to a mortgage than meets the eye. Here’s what a mortgage really is, how it works, and the different options available.

Read more

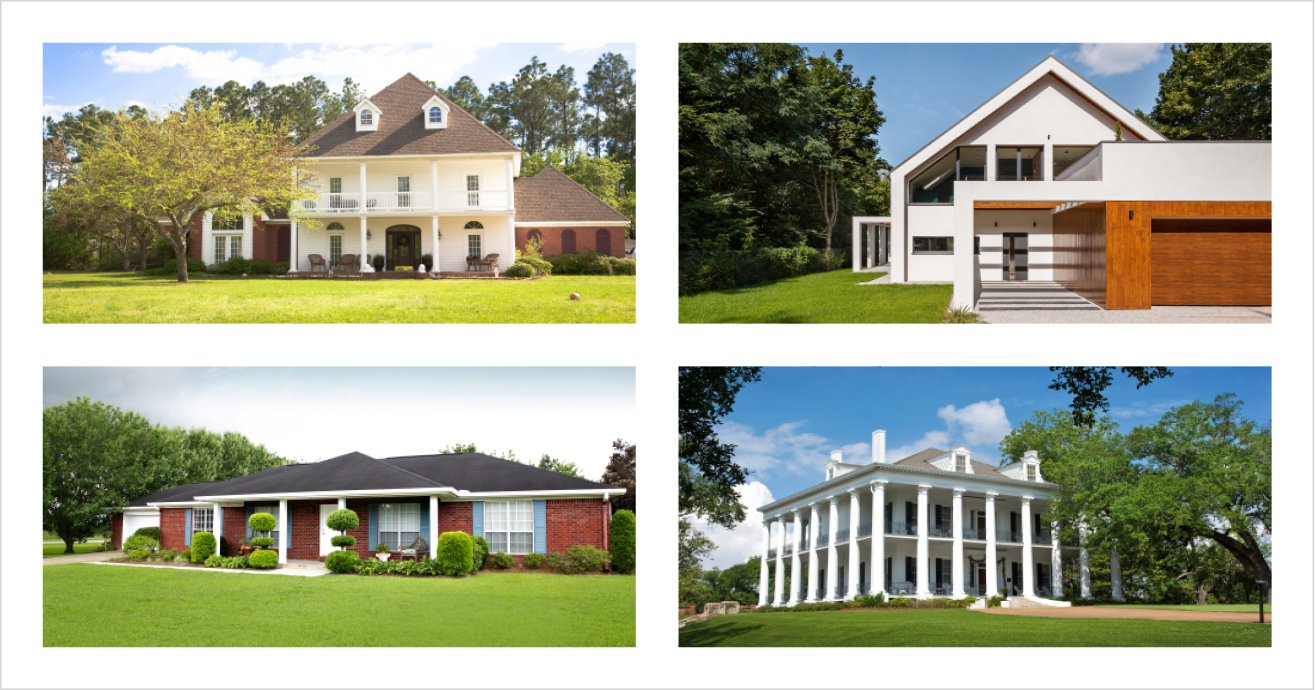

Learn about 14 different types of home styles, from ranch to Victorian, and discover which features, layouts, and designs best match your lifestyle and needs.

Read more

Buying a house? Learn how your property type—primary residence, second home, or investment property—affects your mortgage rates, including investment property mortgage rates vs primary residence.

Read more

Need something else? You can find more info in our FAQ